New Science of Forex Trading | NSOFT Free Download

In this article we will discuss the new scalping strategy New Science of Forex Trading (NSOFT). This strategy is very popular and discussed on many popular blogs and forums. The strategy of actively sold on Clickbank, but that did not stop one of the buyers to provide this system for our website. That's how it is paid quickly turns into a free.

Characteristics of New Science of Forex Trading

- Platform: Metatrader4

- Currency pairs: Any, recommended major

- Trading Time: Around the clock

- Timeframe: M5 and higher

- Recommended broker: RoboForex, InstaForex, Forex4you

Indicators

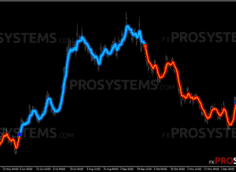

- Moving Average - the standard trend indicator for the platform MetaTrader 4. This system uses crossing of two moving with a period of 6, only one moving is a shift to 1 and the other moving there is no shift. These parameters are chosen for scalping on M5, so that you can optimize these parameters for yourself.

- DED - indicator is displayed as dots of blue and yellow color above and below the price. Indicator author, but at once on the eyes, I can say that this is nothing more than a modification of the standard indicator Parabolic.

- TES - the indicator located in the first additional window as a histogram of blue and orange. Author strategy closed his indicator settings, so that on the basis of which it was created, I cannot tell you. The system performs the function of a filter: blue bars - buy, orange - sell.

- TTL - the indicator is in the second additional window is displayed as a histogram of red and green colors. Indicator serves in the role of the filter and is based on the oscillator will likely Stochastic, where you can specify the period and modify the overbought and oversold (in this case 30 and 70). These parameters can be optimized for the trader himself.

Also present informer in the upper left corner, but its value is visually understandable, so that it does not accentuate attention.

Signals of Strategy New Science of Forex Trading

In the strategy stipulated a comparison of the trend with a larger timeframe, that is, if we work on the M5, the confirmation of the signal are looking at M15. Analyze signals in accordance with the following scheme:

| Time Frame for trade | Time Frame for filtering |

|---|---|

| M5 | M15 |

| M15 | M30 |

| M30 | H1 |

| H1 | D1 |

| D1 | W1 |

| W1 | MN |

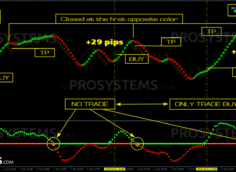

Signals to open a Long position

To enter a long position should be simultaneously compliance with a number of the following terms:

- Moving Average indicator with a period of 6 blue line crosses the Moving Average indicator yellow from the bottom up

- Point of DED indicator should be blue

- Bar of an indicator histogram TES should be blue

- Bar of an indicator histogram TTL colored green

If all conditions were met, go to M15 (if we trade on M5) and look at the histogram indicators TES and TTL, their bars shall be painted blue and green. If the signal is confirmed we open a long position:

Signals to open a Short position

To enter a Short position should be simultaneously compliance with a number of the following terms:

- Moving Average indicator with a period of 6 blue line crosses the Moving Average indicator yellow from the top down

- Point of DED indicator should be yellow

- Bar of an indicator histogram TES should be orange

- Bar of an indicator histogram TTL colored red

If all conditions were met, go to H4 (if we trade on H1) and look at the histogram indicators TES and TTL, their bars shall be painted orange and red. If the signal is confirmed we open a Short position:

Stop Loss

Stop Loss set in the classical way - namely, on local minimum and maximum or important support and resistance levels:

Exit

Analyzing video reports author strategies, I saw that the way exit of the position is on the set Take Profit, which is equal to the Stop Loss. But looking at the strategy New Science of Forex Trading on history, I venture to suggest that in this way the author goes out prematurely, and can use alternative way, for example, on the opposite signal.

Money Management

In trading, money management is responsible for the stable growth of your deposit. Strategy New Science of Forex Trading is positioned as a scalping system, therefore it is strongly recommended not to exceed 1% of the risk in one position.

I think the strategy of New Science of Forex Trading has the right to exist. In fact, we have two moving averages and two oscillators that are created, most likely, on the basis of standard indicators. In the strategy provided for a filter to a higher timeframes, it helps not to miss and go against the trend (I'm not talking about the global, but about the mikrotrende, which is present in the moment, sometimes it's just a rollback). Parameters of indicators selected wisely, and all the indicators look at the chart organically. In general, I recommend testing the strategy, it deserves attention.

In the archives Forex_Triple_B_Strategy.rar:

- DED.ex4

- KPI.ex4

- TES.ex4

- TTL.ex4

- newscienceofforextrading.tpl

- New Science of Forex Trading Manual.pdf

Free Download New Science of Forex Trading

!

!