USA Bank Academy FX Hedge Fund Strategy V1.0 - Free Download

USA Bank Academy FX Hedge Fund Strategy V1.0 is a fundamental trading system of major USA banks and hedge funds, which helps them to profitably manage the money of investors and depositors. The indicators of this strategy are not repainted at the onset of a new candle (bar), if the sellers of this strategy are to be believed. But when do the sellers tell the truth?

In addition, they claim that similar to how banks prioritize low risk and low exposure to capital while striving for high and very high potential earnings, this system operates with great precision. The rewards are substantial, with initial TP1 being 1:1 or 1:2, TP2 1:2 to 1:4, and TP3 staying open for potentially extremely large earnings up to 1:10.

Characteristics of the USA Bank Academy FX Hedge Fund Strategy V1.0

- Platform: Metatrader4

- Currency pairs: Any currency pairs, recommended Major

- Trading Time: Any, recommended London and New York trading sessions

- Time Frame: H4

- Recommended broker: Roboforex, XM, FBS

Indicators of the System

USA Bank Academy FX Hedge Fund Strategy consists of three indicators:

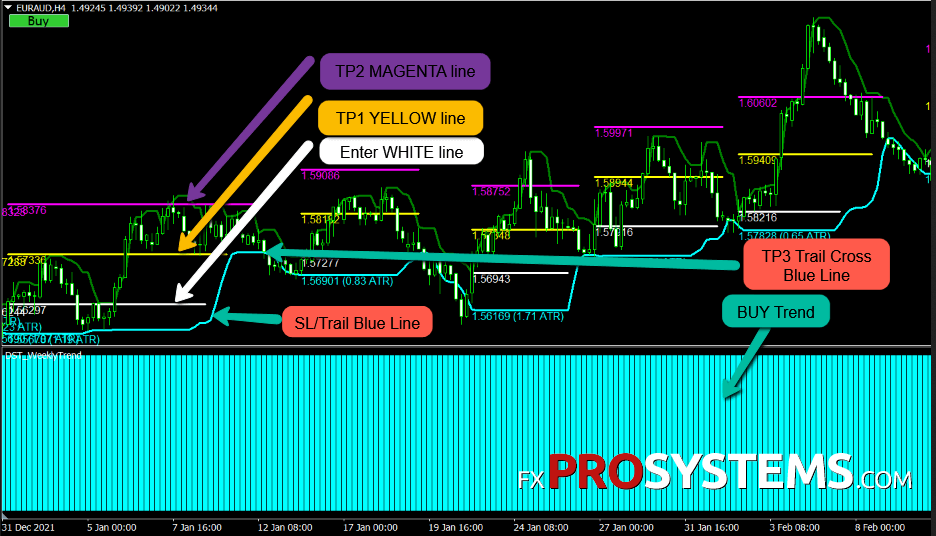

1. DST_WeeklyTrend - the main indicator of the current trend, which indicates that we should consider only BUY (if the color is Aqua) or only SELL (if the color is Magenta)

2. TOP_Ultimate_Breakout - Alert and a set of colored lines and levels, which help in setting targets (TP) and Stop Loss and Trail SL levels:

- The LIGHT BLUE LINE (AQUA) is where you can place your Stop Loss, and it's dynamic to adjust as price changes and can be used as a Trail SL.

- The WHITE LINE is where you can place a BUY or SELL order.

- The YELLOW LINE is the first TP1, the MAGENTA LINE is the second TP2, and the LIGHT BLUE LINE (AQUA) is the third TP3, which can also be used as a Trail SL.

- Remember: When the price hits TP1, move your SL to break-even, then use the LIGHT BLUE LINE (AQUA) as your Trail SL.

3. DST_WeeklyTrendBars is an auxiliary indicator, which colors the bars according to the current trend. Apply the "BUY Template WEEKLY BARS" or "SELL Template WEEKLY BARS" if you want the candles to be more visible.

Thus, when entering the market, we will mainly rely on the readings of the first two indicators.

Trading rules

BUY INSTRUCTIONS:

- Verify that the trend is for "BUY" (represented by blue bars).

- When you spot a global trend (indicated by the bottom trend indicator), apply the "BUY TEMPLATE".

- After the candle touches or crosses the "LIGHT BLUE LINE (AQUA)" following your previous trade close or Stop Loss activation, place a "BUY STOP" pending order on the "GREEN LINE" above the "LIGHT BLUE LINE (AQUA)".

- When "BUY STOP" is triggered, you will see the network with "ENTER line (WHITE)," "TP1 line (YELLOW)", and "TP2 line (MAGENTA)". Place TP1 and TP2 there and place SL a few pips below "LIGHT BLUE LINE (AQUA)". For TP3, use Trail Stop and close it when price reaches "LIGHT BLUE LINE (AQUA)".

- Note: It is recommended to enter a "BUY" manually or with a pending order in three separate orders to have three TPs (TP1/TP2/TP3).

- Keep in mind: when price hits TP1, move SL to Break Even and after that use "LIGHT BLUE LINE (AQUA)" as your Trail SL.

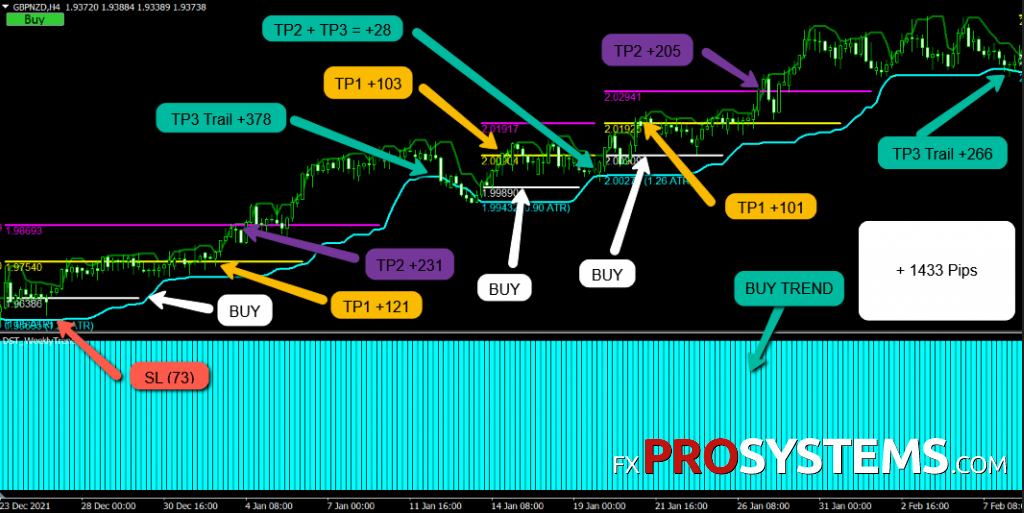

BUY rules example:

As you can see, you have three TPs with a total of +1433 pips in the wave.

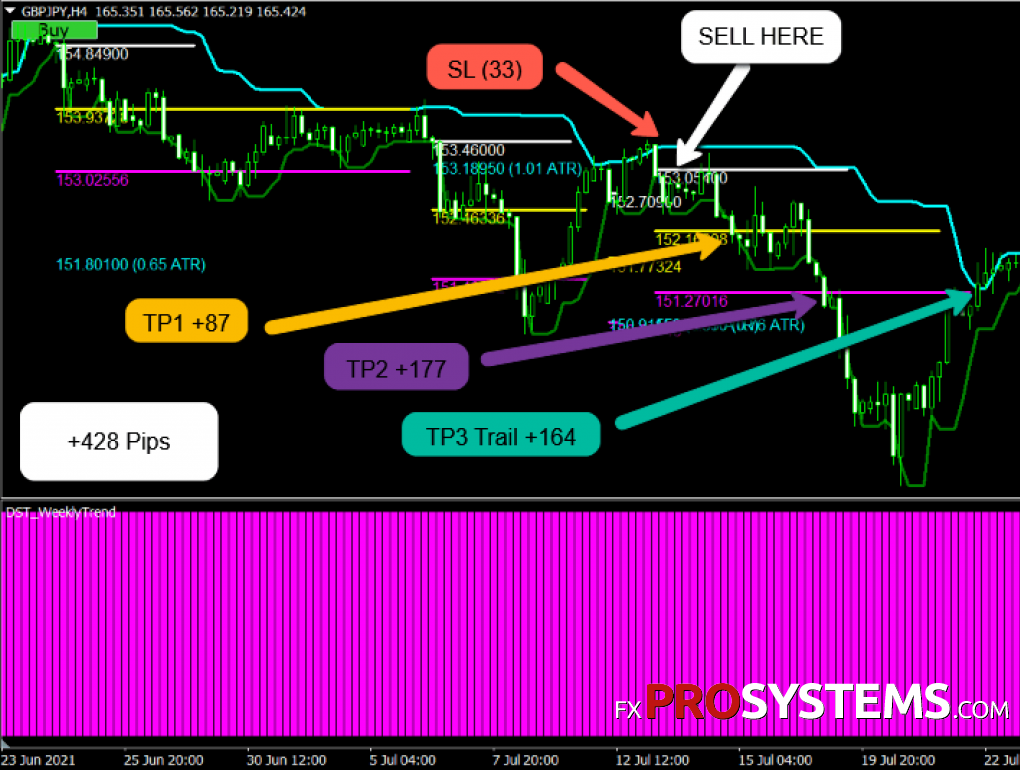

SELL INSTRUCTIONS:

- Verify that the trend is for "SELL" (represented by magenta bars).

- When you spot a global trend (indicated by the bottom trend indicator), apply the "SELL TEMPLATE".

- After the candle touches or crosses the "LIGHT BLUE LINE (AQUA)" following your previous trade close or Stop Loss activation, place a "SELL STOP" pending order on the "GREEN LINE" below the "LIGHT BLUE LINE (AQUA)".

- When "SELL STOP" is triggered, you will see the network with "ENTER line (WHITE)," "TP1 line (YELLOW)," and "TP2 line (MAGENTA)". Place TP1 and TP2 there and place SL a few pips above "LIGHT BLUE LINE (AQUA)." For TP3, use Trail Stop and close it when price reaches "LIGHT BLUE LINE (AQUA)".

- Note: It is recommended to enter a "SELL" manually or with a pending order in three separate orders to have three TPs (TP1/TP2/TP3).

- Keep in mind: when price hits TP1, move SL to Break Even and after that use "LIGHT BLUE LINE (AQUA)" as your Trail SL.

SELL rules example:

Of course, this strategy has the potential and the correct logic, but you should not blindly rely on it, completely trusting your capital to its signals. Use additional filters. Be sure to use Money Management with low risk, no more than 5% per trade. And, of course, before real trading, you need to work with this system on a demo account for at least a month (for H4 TF).

In the archive FX_Hedge_Fund_Strategy.rar (2.1 MB):

- DST_WeeklyTrend.ex4

- DST_WeeklyTrendBars.ex4

- TOP_Ultimate_Breakout.ex4

- BUY Template WEEKLY BARS.tpl

- BUY template.tpl

- SELL Template WEEKLY BARS.tpl

- SELL Template.tpl

- User Guide USA Bank Academy.pdf

Free Download USA Bank Academy FX Hedge Fund Strategy V1.0